A back-of-the-envelope look at how PCE and renewables interact in rural Alaska

Wind turbines outside of Nome, Alaska

By: Michelle Wilber, Steve Colt and Shivani Bhagat

June 28, 2024

Thanks to the generous contributions during many meetings on this topic by Katya Karankevich, Ingemar Mathiasson, Matt Bergen, Chris Pike, Christie Haupert and others. Thanks to the Sloan Foundation for funding this exploration through the UVM-led research ‘Integrated renewable energy community microgrid transitions and energy sovereignty in remote communities in Alaska.

Across the circumpolar North, interest in the creation of independent power producers (IPPs) to own and operate renewable power systems is growing. In Alaska’s Northwest Arctic Borough, energy manager Ingemar Mathiasson has championed the creation of several Tribal and community-owned IPP renewable systems, including the Shungnak-Kobuk Community Solar IPP project which was selected as a Grand Prize winner for the 2022 Sunny Awards for Equitable Community Solar by the U.S. Department of Energy. Mathiasson cites many benefits of the IPP model to integrate renewable resources into remote microgrids, including: reduced imported fossil fuel consumption, local job creation, increasing local energy sovereignty, and the potential to stabilize energy rates for the future. IPPs and the integration of renewables more broadly, also raise some interesting questions for Alaska’s Power Cost Equalization program.

Power Cost Equalization (PCE) is a state program that provides electric utility reimbursements for high power costs in rural Alaska, and was established in 1984 to help share the benefits of state investment in the power system and power generation from hydropower projects in other parts of the state. PCE payments come from an endowment fund. According to Terri Harper, CFO at Iliamna Newhalen Nondalton Electric Cooperative, Inc. (INNEC), yearly earnings from the endowment are first used to fund the PCE program, then it is used for community assistance, the rural power system upgrade program, the bulk fuel upgrade program, and lastly Renewable Energy Fund projects. Every year since the endowment was established, PCE has been funded 100% from the endowment earnings with money left for the other programs. This arrangement is always subject to approval – or to change – by the Alaska Legislature, which makes the actual appropriations to all of these programs each year.

PCE is challenging to really understand. It is calculated based on a formula with many components, it applies to only some of the utility’s sales, maximizing benefits is dependent on effective reporting to two different state agencies (the Regulatory Commission of Alaska (RCA) and the Alaska Energy Authority), and parts of it have changed with time. Understanding how PCE works with energy efficiency and renewable energy efforts can be especially challenging. One common worry is that it disincentivizes energy efficiency upgrades and the addition of renewable energy generation by trying to bring residential customer rates close to the railbelt utility rates, with little incentive to lower fuel costs (other than a penalty for inefficiency in generation and distribution).

Almost all of the utility scale renewables that have been installed to date in rural Alaska have been funded by state and federal grants and therefore associated capital and financing costs do not count as valid expenses eligible for PCE reimbursement, since the utility is not paying them. This could be a problem, since it could hinder the ability to build up a capital reserve for replacement of the renewable energy infrastructure at the end of its life. However, any PCE reimbursements for depreciation would only allow the utility to build up such a fund if the utility used its own capital to pay cash up front for a project. If instead a loan is used, any reimbursements for depreciation and/or interest would need to be used to pay off the loan and could not be retained as a reserve. And, as mentioned above, because PCE is formulated to try and equalize power costs for residential and community building customers with those in lower cost regions of the state, energy generated by renewables doesn’t necessarily lower the PCE-adjusted rate for PCE-eligible customers, even if it does lower utility costs and thus the non-adjusted rates which are paid by commercial and government customers. For example, with all-diesel generation, PCE might lower the residential customer rate from 40 cents to 21 cents. With grant-funded wind power, PCE might lower the rate from 30 cents to 20.5 cents. PCE makes up 95% of the difference between allowable cost and a base amount (20 cents in this example).

A statistical analysis of PCE data for 165 communities performed by ACEP in 2019 showed that every 10% increase in the electricity generated by wind in diesel communities correlated with about a 1.5 cent lower residential (non-PCE adjusted) rate, and a 0.8 cent lower PCE-adjusted rate. It’s not huge, but at least statistically it is showing that grant funded renewables might stabilize or lower rates a small amount for PCE customers, and even more for those that don’t get PCE. Having wind power in communities also appeared to buffer the effect of higher fuel prices on electric rates, as one would hope! But the truth remains, the customer, especially the residential customer, is not likely to see a meaningful decrease in their bill after a wind or solar project goes in, and that can be disappointing to them.

Recently, there have been some innovations in ownership structure that have worked to bring more benefits to the community. Instead of the grant going to the utility to install and own the renewable, it can go to the Tribe (or potentially another community-oriented non-profit) who operates as an Independent Power Producer (IPP), which then charges the utility for power under a Power Purchase Agreement (PPA). This charge is an allowable expense to the utility and is eligible for PCE reimbursement, while the money earned by the IPP can then be used for some combination of the following: paying for administrative costs of running the IPP (including staffing that can bring job opportunities and added capacity to the community), maintenance on the renewable, saving for replacement at the end of its life, and/or community programs. It is unclear whether or how IPP revenues could be recycled to the community in the form of reduced energy costs - for example, by paying for energy efficiency upgrades or simply subsidizing the cost of heating fuel.

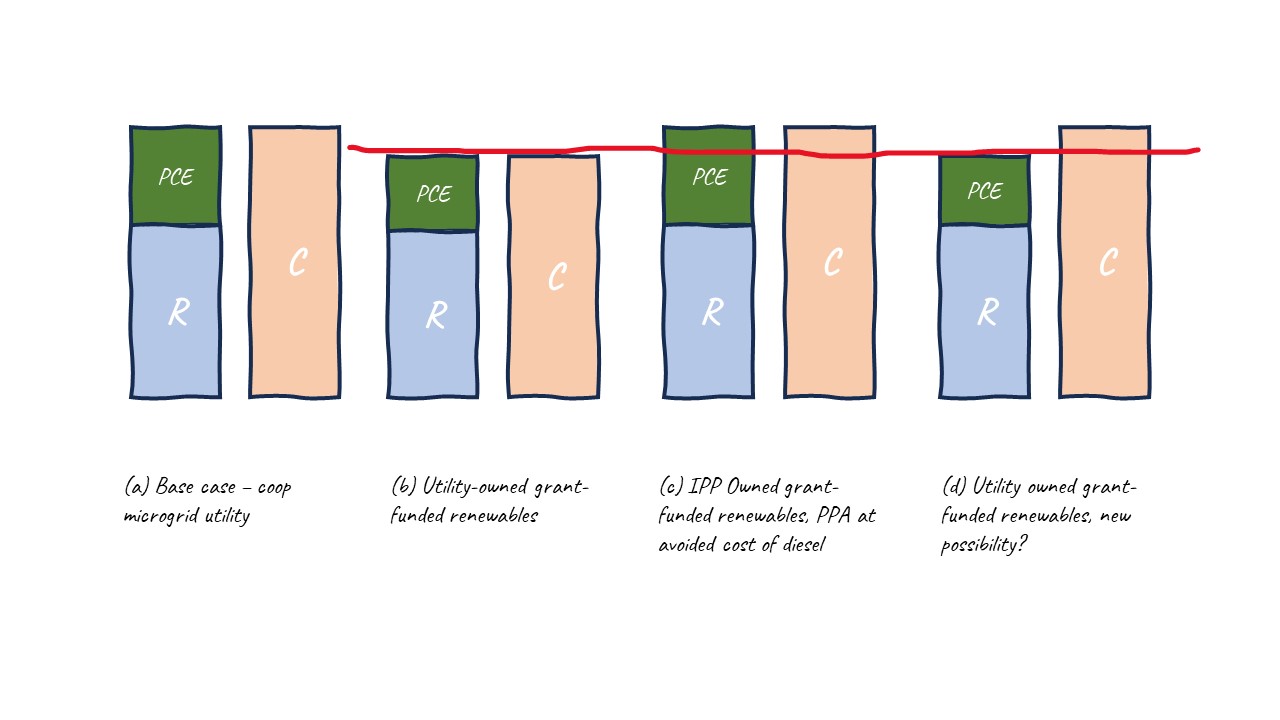

An illustration of various cases is given below in Figure 1, where residential rates are blue, with the PCE reimbursement in green and commercial rates are represented by the accompanying orange bar. The effective (PCE-adjusted) rate paid by the residential customer up to the monthly cap (currently 750 kWh) is at the line dividing the blue from the green sections. No numbers are presented to keep this discussion general and applicable to many communities, amounts, and types of renewable capacity added, etc.

In the first set of bars (a), we see the case before grant-funded renewables are installed. Often the commercial and residential rates are the same, per kWh, as shown. If the utility is not regulated by the RCA, as most of these non-profit utilities are not, there is a lot of latitude in setting these rates, but PCE program compliance can be a de facto regulation, at least on the residential rate.

In the second set of bars (b), we see the general behavior after utility-owned grant-funded renewables are installed. Fuel usage is displaced, so costs go down and rates can go down. However, PCE also goes down, leaving the PCE-adjusted or “effective” residential rate about the same - so those customers don’t notice any immediate benefits. The commercial customers should actually benefit from lower rates, but if they are an entity that passes these expenses to the state or federal government they might not care that much. The state itself might benefit from lower electricity costs for its facilities, and other communities might benefit from leaving more of the PCE endowment earnings on the table for other energy programs including more renewable energy projects. The non-profit utility should still be generally in the same place.

Figure 1 - Four possibilities for residential rates (R) , commercial rates (C) and PCE reimbursements in an Alaskan PCE community, described above

The third set of bars (c) represents purchase of electricity by the utility from an IPP at a rate equal to the avoided cost of diesel generation. Rates stay about the same as in the base case shown by the (a) bars. The red line divides off the portion of the rate, above the line, that goes to pay the IPP for electricity, and can be used by the IPP to run itself, maintain the renewable energy generation, and benefit the community and/or the future of replacement and/or additional renewable generation. Again, the utility is whole (i.e. isn’t losing money), residential customers shouldn’t notice a change, commercial customers shouldn’t notice a change over the base case, but there will be slightly less PCE earnings left in the endowment fund’s coffers to pay for other energy programs all over the state, at least relative to case (b) in the figure.

In the fourth set of bars (d) we imagine something different. It may be ill-conceived, but as a thought experiment, we’ll go through it. The utility owns the grant-funded renewable and all is the same as in the second case, EXCEPT the utility decides to keep the commercial rate at what it was before the renewable started displacing diesel and lowering costs, and uses the extra income (above the red line) for allowable community endeavors (scholarships perhaps, or other programs similar to what the IPP would fund). To the electricity customer, rates should look about like they do in the IPP case. Less PCE money would be coming into the community, the difference being the part that would have gone to the IPP for community programs and administration.

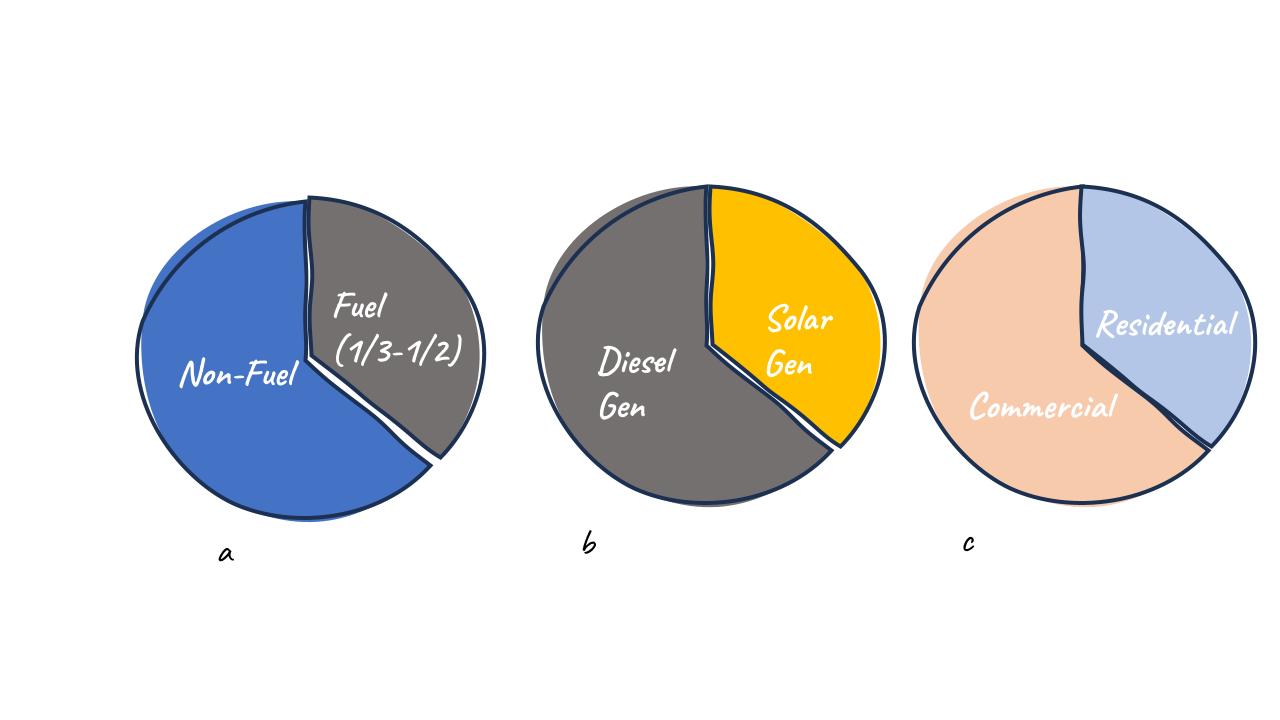

Figure 2

Some rough divisions relevant to Alaska diesel microgrid communities (thanks to Katya Karankevich of ANTHC for this insight):

-

- About ⅓-½ of utility costs are fuel costs, with the rest non-fuel (power lines, billing, administration, maintenance, etc).

- In some of the newer, high penetration solar projects in rural Alaska (e.g. Shungnak), about ⅓ of the power generated for the community comes from solar, the rest diesel

- In many rural communities, about ⅓ of the electricity sales are to residential customers. These are eligible for PCE reimbursement up to a monthly cap per customer. A small amount goes to community buildings that can also be eligible for PCE. The rest go to commercial customers that are not PCE eligible (businesses, schools, the airport, state and federal offices, etc).

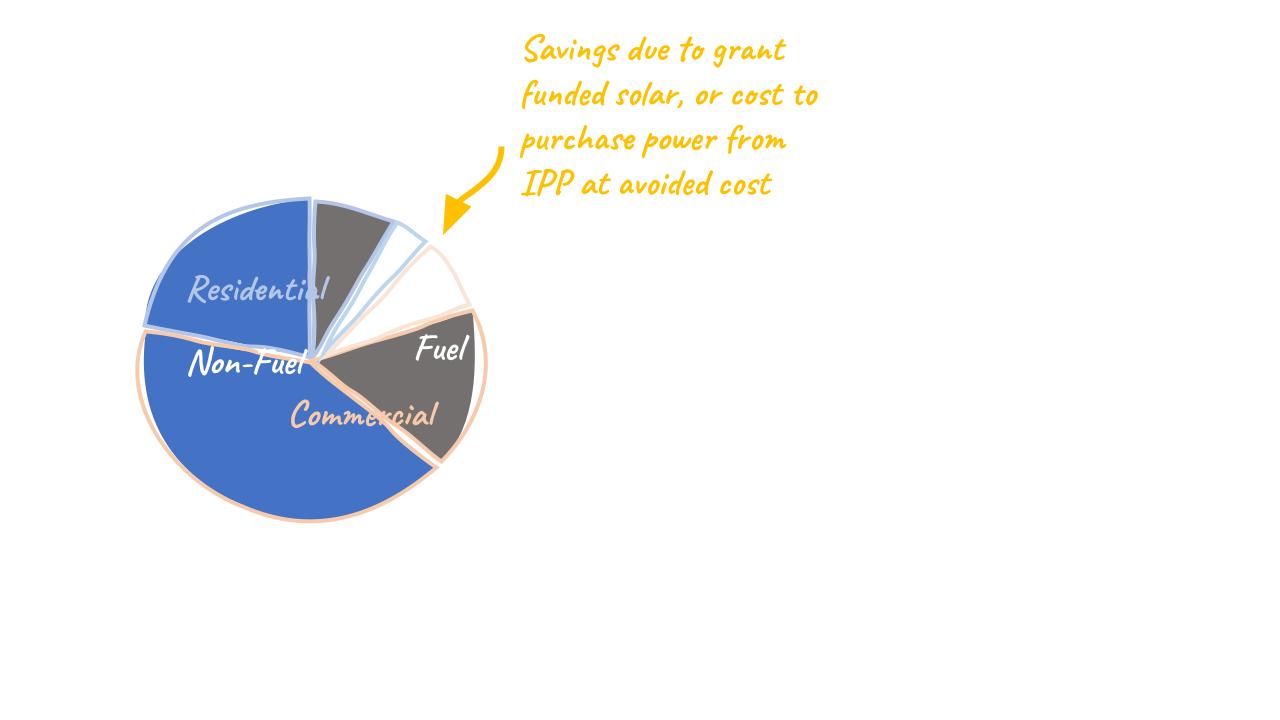

If we put all of this together, we get something like the figure below, where the thin white gap (~1/9th of the pie) is the operational savings from installing a grant-funded renewable project that generates about ⅓ of the electricity used in a community. This can either be used to lower rates to commercial customers and PCE money going into a community (Figure 1b - second set of bars), increase money going to an IPP and, hopefully, community programs (Figure 1c - third set of bars), or possibly bring in some money (the small empty commercial wedge) to community programs while lowering PCE money coming into the community (Figure 1d). Your preference might depend on whether you are the community, a local business, the utility, another community trying to get a Renewable Energy Fund grant, or a legislature trying to build a state budget while also doing the right thing for rural communities.

Figure 3

What about heat?

Wind and solar are variable renewables - the amount they can produce varies greatly throughout the day and year depending on the weather. Because of this, large projects that can produce about a third or more of a community’s energy often have periods of time where they are capable of producing more power than the community can use simultaneously. Even with economically sized battery storage, there will likely be periods of excess power available. One proven way to take advantage of this otherwise curtailed power is to direct it to heating. Maniilaq Hospital in Kotzebue saves about $92,000 a year from using excess wind, when it is available, from Kotzebue Electric Association to provide facility heat at a savings over burning fuel oil for heat. One pertinent question is how PCE applies to sales of otherwise excess renewable generation to heat. The example of INN Electric Cooperative’s sales of excess hydro provides some insight into how this can be treated within the PCE program. Excess hydro is used to serve the school district under what is labeled a "dump energy " program, and the utility does not incur an incremental cost to do this. Back in 2000, the RCA addressed the question of how to account for these sales in Docket U-00-105. The Commission found that:

“INN sold "dump energy" to the school district to supplement or replace oil-fired heat in the schools. At $.05 kW, the school district finds it economical to replace oil-fired heat. The sale of "dump energy" provides INN with revenue for energy that would otherwise be lost to the load bank or pass by the turbines. We find that projects that reduce the use of heating oil in rural areas of Alaska are beneficial to all concerned.”

The Commission therefore decided that:

“ "dump energy" is comparable to, and should be treated in the same manner for PCE purposes as, the sale of jacket water heat from diesel generators.”

Source: Both quotations are from Order U-00-105(2) dated 9/7/2000. Available at rca.alaska.gov tracking number 00-0570.

What happens if the renewable generation is owned by an IPP? Presumably the IPP can’t legally get into the business of selling ‘excess’ generation directly to the consumer as that would be in competition with the utility, but perhaps there is a way to do this. Perhaps the utility would be able to purchase excess generation at a discounted price from the IPP (since it is being generated at zero marginal cost) and pass along that low price to controllable heat loads that only use this excess power. However, If there is no discount for these kWh from the IPP, it makes less sense for the utility to then try to create a lower heat rate for customers to compensate them for the utility’s control of the load, so incentivizing a beneficial match between a variable renewable generation resource like wind and solar and a controllable end use like heating or EV charging (where either storage or a secondary source of heating makes the timing more flexible to the end user) becomes more challenging - though not impossible. We hope to explore these challenges in future blog posts - so stay tuned!

Some thoughts on PCE and renewables from a rural energy perspective

An original champion of the IPP model of solar ownership in rural Alaska and Northwest Arctic Borough Energy Manager, Ingemar Mathiasson has some further thoughts on the priorities for renewables and PCE in rural Alaska:

- Develop locally available energy resources to the largest extent possible for local use. This will:

-

-

- Minimize the need for importation of fossil fuels.

- Stabilize the cost of energy for the future

- Create local jobs

- And lower the community carbon footprint.

-

- As much as possible, aim to preserve the communities allocation of PCE, as this is needed to maintain and service the systems. It’s not a subsidy, it’s an endowment. Realize that all of Alaska's Household rates per kWh are (ideally) the same under the PCE fund.

- Analyze the grant funded projects to see if they are financially sound. Since they will need to be replaced at their end of life, make sure that utility rates continue to reflect the full cost of system replacement including principal and financing costs so that funds are available for future replacement.

- Engage the communities and help them realize their role in having control of their own energy future through the possibility of becoming an IPP (Independent Power Producer). This increases energy sovereignty and sovereignty of the Tribe by generating local funds to take care of their energy production. Additionally it creates a unified approach to community collaboration and understanding. Tribe-City-Utility.

Additionally, Ingemar notes that over time, fuel costs have increased to the point where more and more communities are now producing power at over $1.00/kWh. This limits the PCE reimbursement for these communities, since this is a ceiling in the PCE calculation which has not been updated to reflect the upward trend in costs.

PCE was developed at a time when there was, broadly, one type of generation, one type of load, and one model for generation ownership in the communities it served. We will continue to work to understand how the inclusion of new types of power generation, new types of loads, and new ownership models interact with PCE and to communicate any insights to help Alaskans make informed decisions.