Slide show: Market opportunities for shellfish aquaculture

Transcript of slides

Slide 1

Market Opportunities For Shellfish Aquaculture

Shellfish Aquaculture Conference

Anchorage, Alaska

December 3, 2004

Howard M. Johnson

H.M. Johnson & Associates

Slide 2

Howard M. Johnson

Howard@hmj.com

www.hmj.com

www.fishjobs.com

30+ years in the seafood industry

15+ years in seafood consulting and market research

Slide 3

Shellfish Marketing Agenda Shellfish Marketing Agenda

The view from 30,000 feet

- World seafood supply demand trends

- Forecast world demand

- Japan

- China

- Europe

- United States

- World cultured shellfish production

- U.S. shellfish culture issues/opportunities

- Marketing opportunities for Alaska

Slide 4

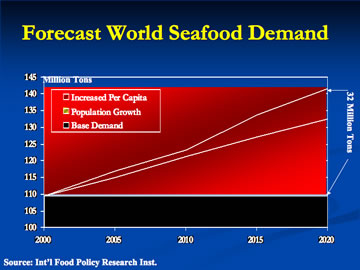

Forecast World Seafood Demand

Graph image: Showing how the demand will increase from 2000 - 2022 of seafood. Source: Int’l Food Policy Research Inst.

Slide 5

Japan

Image: Showing Japan seafood

Slide 6

Japanese Seafood Supply

Trending Lower

Graph image: Showing the decrease of supply from Japan from 1994 - 2003 in imports, aquaculture, and fisheries.

Slide 7

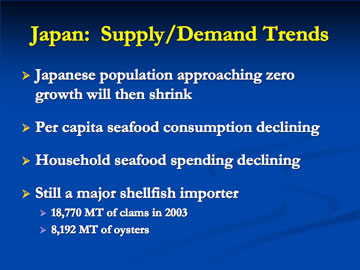

Japan: Supply/Demand Trends

- Japanese population approaching zero growth will then shrink

- Per capita seafood consumption declining

- Household seafood spending declining

- Still a major shellfish importer

- 18,770 MT of clams in 2003

- 8,192 MT of oysters

Slide 8

Japan 2020 A Shrinking Market

Graph image: Showing how the market will decline from 2000 - 2020

Slide 9

China

Image: Showing China scenic

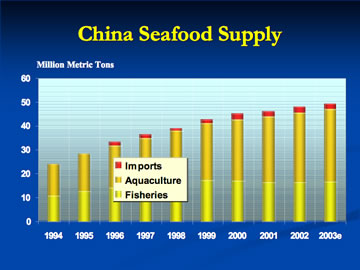

Slide 10

China Seafood Supply

Graph image: Showing the increase of supply from China from 1994 - 2003 in imports, aquaculture, and fisheries.

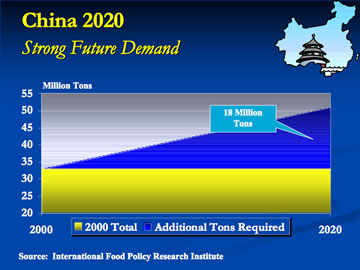

Slide 11

China 2020

Strong Future Demand

Graph image: Showing how the demand will increase from 2000 - 2020. Source: International Food Policy Research Institute

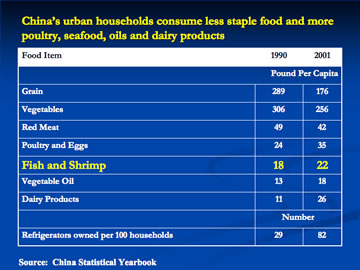

Slide 12

China’s urban households consume less staple food and more poultry, seafood, oils and dairy products

| Food Item | 1990 | 2001 |

|---|---|---|

| Pound Per Capita | ||

| Grain | 289 | 176 |

| Vegetables | 306 | 256 |

| Red Meat | 49 | 42 |

| Poultry and Eggs | 24 | 35 |

| Fish and Shrimp | 18 | 22 |

| Vegetable Oil | 13 | 18 |

| Dairy Products | 11 | 26 |

| Number | ||

| Refrigerators owned per 100 households | 29 | 82 |

Source: China Statistical Yearbook

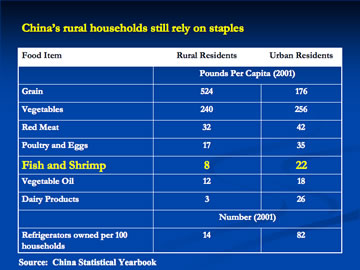

Slide 13

China’s rural households still rely on staples

| Food Item | Rural Residents | Urban Residents |

|---|---|---|

| Pounds Per Capita (2001) | ||

| Grain | 524 | 176 |

| Vegetables | 240 | 256 |

| Red Meat | 32 | 42 |

| Poultry and Eggs | 17 | 35 |

| Fish and Shrimp | 8 | 22 |

| Vegetable Oil | 12 | 18 |

| Dairy Products | 3 | 26 |

| Number | ||

| Refrigerators owned per 100 households | 14 | 82 |

Source: China Statistical Yearbook

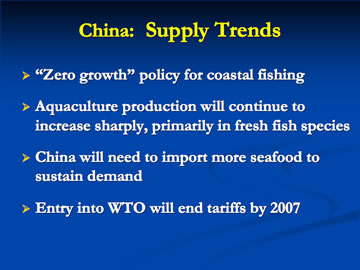

Slide 14

China: Supply Trends

- “Zero growth” policy for coastal fishing

- Aquaculture production will continue to increase sharply, primarily in fresh fish species

- China will need to import more seafood to sustain demand

- Entry into WTO will end tariffs by 2007

Slide 15

China: Demand Trends

- Urban consumer market increasing

- Growth (and consolidation) of retail

- Growth in middle class (with disposable income)

- Demand for upscale seafoods

- Shrimp

- Lobster

- Live fish

Slide 16

Europe

Image: Showing an european fish market

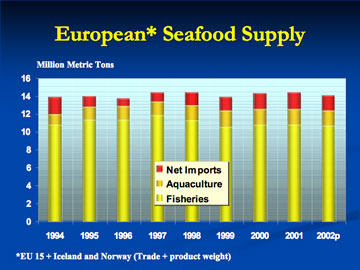

Slide 17

European* Seafood Supply

Graph image: Showing the trends of imports, aquaculture and fisheries for 1994 - 2002. Source: *EU 15 + Iceland and Norway (Trade + product weight)

Slide 18

Forecast European Demand

Graph image: Showing the increase of demand from 2000 - 2020

Slide 19

World Shellfish Culture

Image: Arctic ocean winter scenic

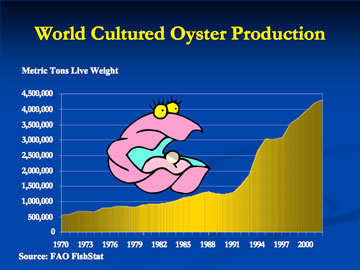

Slide 20

World Cultured Oyster Production

Graph image: Showing the predicted oyster production increase from 1970 to 2000. Source: FAO FishStat.

Slide 21

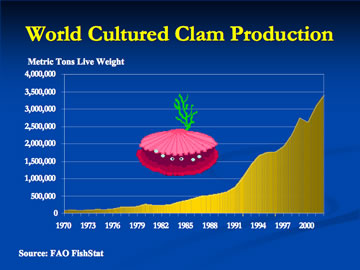

World Cultured Clam Production

Graph image: Showing the predicted clam production increase from 1970 to 2000. Source: FAO FishStat.

Slide 22

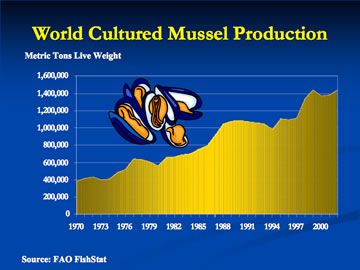

World Cultured Mussel Production

Graph image: Showing the predicted mussel production increase from 1970 to 2000. Source: FAO FishStat.

Slide 23

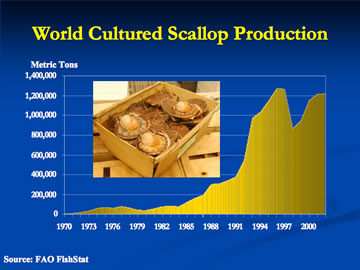

World Cultured Scallop Production

Graph image: Showing the predicted scallop production increase from 1970 to 2000. Source: FAO FishStat.

Slide 24

U.S. Shellfish Market

Image: Water scenic

Slide 25

U.S. Cultured Shellfish Production

Graph image: Showing the predicted oysters, blue mussels, and scallops production increase from 1990 to 2002 in the U.S.. Source: FAO..

Slide 26

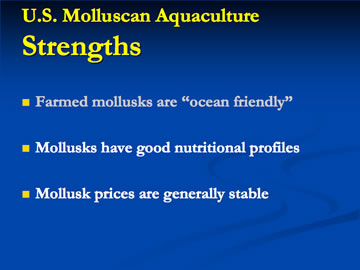

U.S. Molluscan Aquaculture

Strengths

- Farmed mollusks are “ocean friendly”

Slide 27

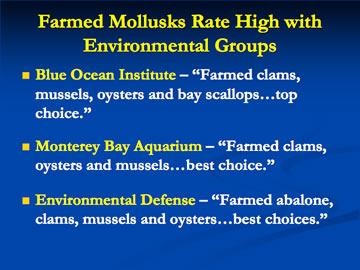

Farmed Mollusks Rate High with Environmental Groups

- Blue Ocean Institute – “Farmed clams, mussels, oysters and bay scallops…top choice.”

- Monterey Bay Aquarium – “Farmed clams, oysters and mussels…best choice.”

- Environmental Defense – “Farmed abalone, clams, mussels and oysters…best choices.”

Slide 28

U.S. Molluscan Aquaculture

Strengths

- Farmed mollusks are “ocean friendly”

- Mollusks have good nutritional profiles

- Mollusk prices are generally stable

Slide 29

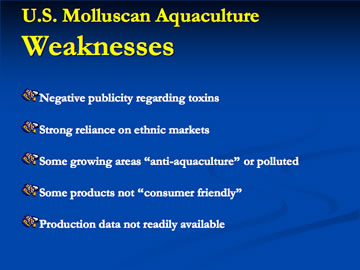

U.S. Molluscan Aquaculture

Weaknesses

- Negative publicity regarding toxins

- Strong reliance on ethnic markets

- Some growing areas “anti-aquaculture” or polluted

- Some products not “consumer friendly”

- Production data not readily available

Slide 30

U.S. Molluscan Aquaculture

Opportunities

- U.S. Seafood market is growing

Slide 31

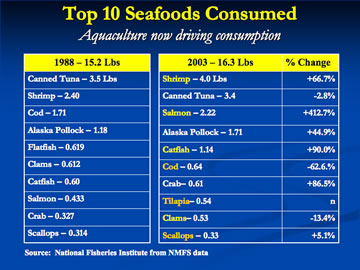

Top 10 Seafoods Consumed

Aquaculture now driving consumption

| 1988 – 15.2 Lbs |

|---|

| Canned Tuna – 3.51 Lbs |

| Shrimp – 2.40 |

| Cod – 1.71 |

| Alaska Pollock – 1.18 |

| Flatfish Flatfish – 0.619 |

| Clams – 0.612 |

| Catfish – 0.60 |

| Salmon – 0.433 |

| Crab – 0.327 |

| 2003 – 16.3 Lbs | % Change |

|---|---|

| Shrimp – 4.0 Lbs | +66.7% |

| Canned Tuna – 3.4 | -2.8% |

| Salmon – 2.22 | +412.7% |

| Alaska Pollock – 1.71 | +44.9% |

| Catfish – 1.14 | +90.0% |

| Cod – 0.64 | -62.6.% |

| Crab– 0.61 | +86.5% |

| Tilapia– 0.54 | NC |

| Clams– 0.53 | -13.4% |

| Scallops – 0.33 | +5.1% |

Source: National Fisheries Institute from NMFS data

Slide 32

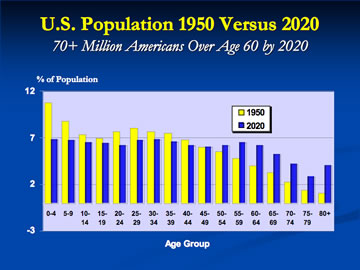

U.S. Population 1950 Versus 2020

70+ Million Americans Over Age 60 by 2020

Graph image: Showing the percent of population by age group from 1950 - 2020

Slide 33

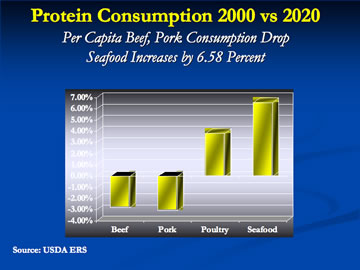

Protein Consumption 2000 vs 2020 Protein Consumption 2000 vs 2020

Per Capita Beef, Pork Consumption Drop

Seafood Increases by 6.58 Percent

Graph image: Showing the percent of drop of meat vs increase of seafood consumption

Source: USDA ERS

Slide 34

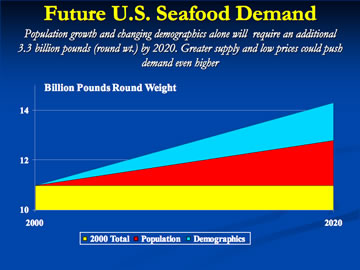

Future U.S. Seafood Demand

Population growth and changing demographics alone will require an additional 3.3 billion pounds (round wt.) by 2020. Greater supply and low prices could push demand even higher

Graph image: Showing the demand for seafood by 2020

Slide 35

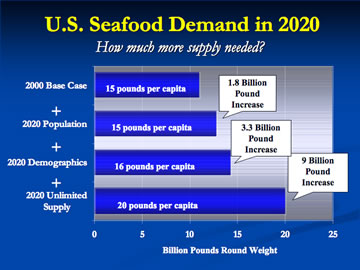

U.S. Seafood Demand in 2020 U.S. Seafood Demand in 2020

How much more supply needed?

Graph image: Showing the demand for seafood by 2020 will be 9 billion pounds increase.

Slide 36

U.S. Molluscan Aquaculture

Opportunities

- U.S. Seafood market is growing

- Away-from-home seafood growth will outpace other proteins

Slide 37

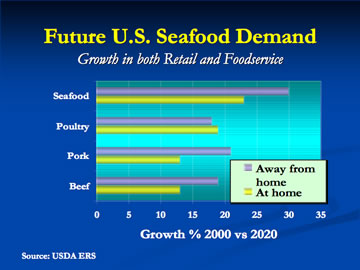

Future U.S. Seafood Demand

Growth in both Retail and Foodservice

Graph image: Showing the growth percentage of 2000 vs 2020 in at home and away from home demand. Source: USDA ERS

Slide 38

U.S. Molluscan Aquaculture

Opportunities

- U.S. Seafood market is growing

- Away-from-home seafood growth will outpace other proteins

- Good export markets

Slide 39

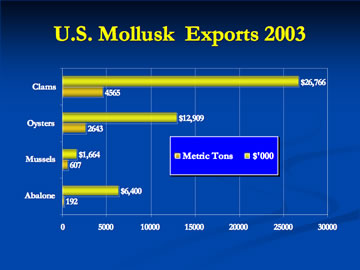

U.S. Mollusk Exports 2003

Graph image: Showing the export by metric ton of clams, oysters, mussels, and abalone in 2003.

Slide 40

U.S. Molluscan Aquaculture

Opportunities

- U.S. Seafood market is growing

- Away-from-home seafood growth will outpace other proteins

- Good export markets

- Processing/packaging technology will provide added safety

Slide 41

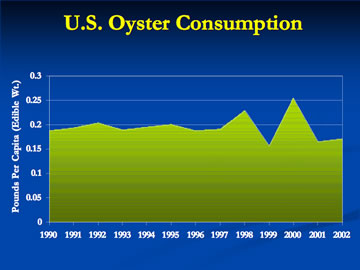

U.S. Oyster Consumption

Graph image: Showing the consumption by pounds per capita of oysters from 1990 to 2002.

Slide 42

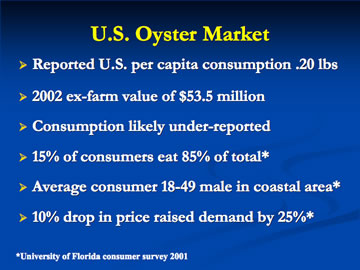

U.S. Oyster Market

- Reported U.S. per capita consumption .20 lbs

- 2002 ex-farm value of $53.5 million

- Consumption likely under-reported

- 15% of consumers eat 85% of total*

- Average consumer 18-49 male in coastal area*

- 10% drop in price raised demand by 25%*

*University of Florida consumer survey 2001

Slide 43

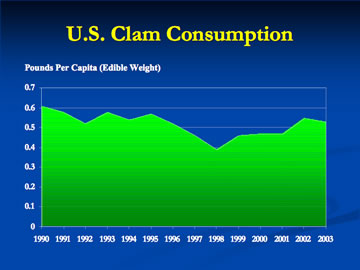

U.S. Clam Consumption

Graph image: Showing the consumption by pounds per capita of clams from 1990 to 2002.

Slide 44

U.S. Clam Market

- Total U.S. consumption of 156 million pounds (edible weight) in 2003

- 2002 reported cultured production of 10 million pounds (meat weight)

- Reported ex-farm value of $10 million

- Cultured geoduck a high-value export

Slide 45

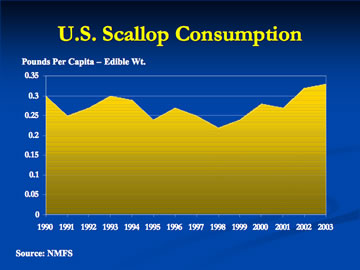

U.S. Scallop Consumption

Graph image: Showing the consumption by pounds per capita of scallops from 1990 to 2003. Source: NMFS

Slide 46

Some Fearless Forecasts for Shellfish Growers for Shellfish Growers

- Demand for oysters, mussels, clams and scallops will grow

- Technology applied to shellfish safety will Technology applied to shellfish safety will mitigate trade/consumer fears

- Retail products will need to be case ready

- Central processing facilities need to achieve economies of scale

- Contract growers

- Co-op processing/marketing

Slide 47

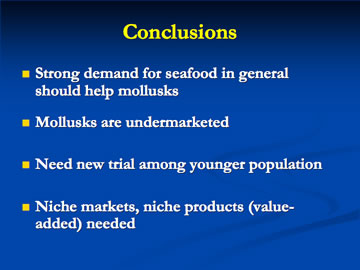

Conclusions

- Strong demand for seafood in general Strong demand for seafood in general should help mollusks

- Mollusks are undermarketed

- Need new trial among younger population

- Niche markets, niche products (value added) needed

Slide 48

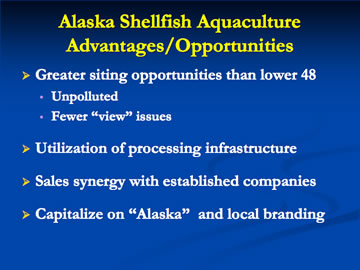

Alaska Shellfish Aquaculture

Advantages/Opportunities

- Greater siting opportunities than lower 48

- Unpolluted

- Fewer “view” issues

- Utilization of processing infrastructure

- Sales synergy with established companies

- Capitalize on “Alaska” and local branding

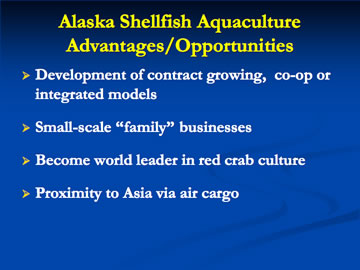

Slide 49

Alaska Shellfish Aquaculture

Advantages/Opportunities

- Development of contract growing, co-op or integrated models

- Small-scale “family” businesses

- Become world leader in red crab culture

- Proximity to Asia via air cargo

Slide 50

Alaska Shellfish Marketing

Opportunities

- Local markets

- National markets

- Niche markets

- Export markets

- Take market share from Canada

Image: Depicting a welcome message from a company or resturant

Slide 51

Image: Showing a oyster resturant menu

Slide 52

Image: Showing a oyster resturant sign

Slide 53

Market Studies on the Net

- New Brunswick Oyster Aquaculture Industry Market Study - no longer available on the net

- Marketing Opportunities for Pacific Oysters – PCSGA Study - no longer available on the net

- Clams Market Research Focus Group Report - no longer available on the net

Slide 54

Thank you